- #TAX BRACKETS 2019 PROFESSIONAL#

- #TAX BRACKETS 2019 FREE#

To print or electronically file your tax return.

Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide. #TAX BRACKETS 2019 FREE#

(TurboTax Free Edition customers are entitled to payment of $30.) Excludes TurboTaxīusiness. Not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or We will not represent you before the IRS or state agency or provide legal advice. Support Center for audited returns filed with TurboTax for the current tax year (2021) and the past two tax

#TAX BRACKETS 2019 PROFESSIONAL#

Will provide one-on-one question-and-answer support with a tax professional as requested through our Audit

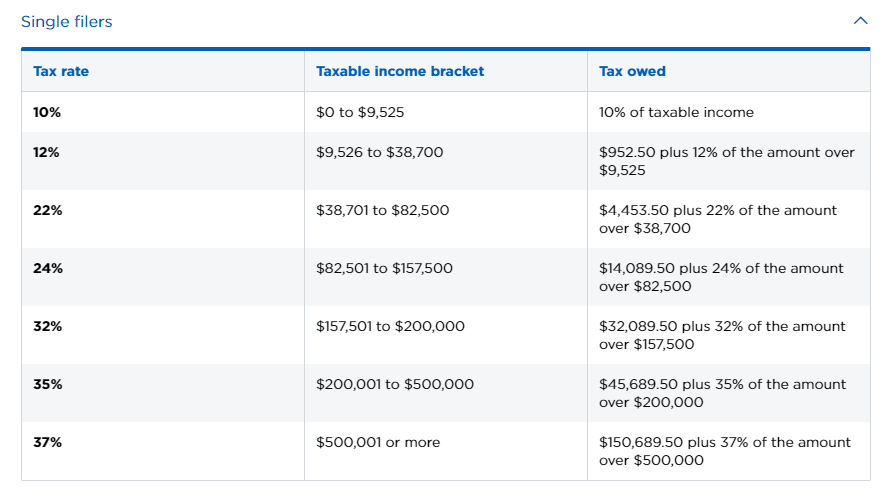

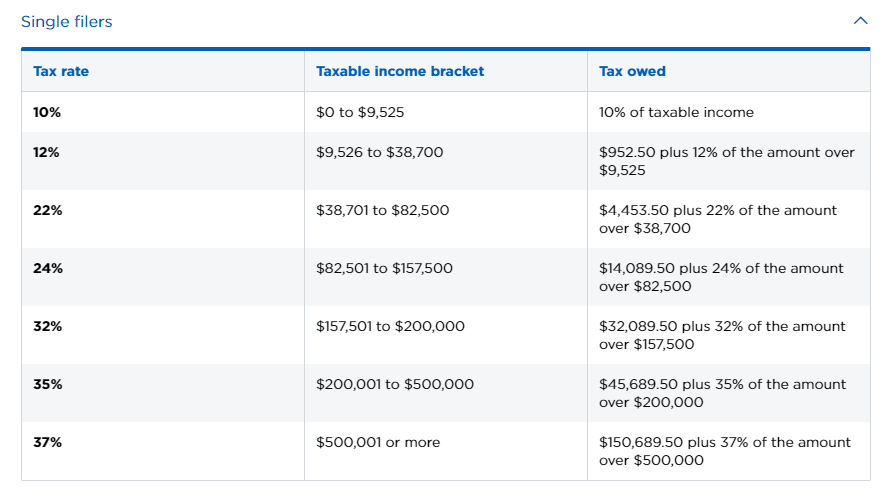

Audit Support Guarantee: If you receive an audit letter based on your 2021 TurboTax return, we. Review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. 100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest)īecause of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section. (TurboTax Online Free Edition customers are entitled to payment of Larger refund or smaller tax due from another tax preparation method, we'll refund the applicable TurboTaxįederal and/or state purchase price paid. Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back: If you get a. Of a TurboTax calculation error, we’ll pay you the penalty and interest. 100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because. Income tax brackets are roughly one half that of the Married Filing Jointly income tax brackets. Jointly double from $10,275 to $20,550 at 10%, and increase far less than double from Notice, however, the Federal tax brackets for Married Filing Tax rate of 37% on taxable income over $647,850.įor the Single, Married Filing Jointly, Married Filing Separately, and Head of Householdįiling statuses, the Federal tax rates and the number of tax brackets. Tax rate of 22% on taxable income between $83,551 and $178,150.  Tax rate of 12% on taxable income between $20,551 and $83,550. Tax rate of 10% on the first $20,550 of taxable income. Tax rate of 37% on taxable income over $539,900.įor married taxpayers living and working in the United States:. Tax rate of 24% on taxable income between $89,076 and $170,050. Tax rate of 22% on taxable income between $41,776 and $89,075.

Tax rate of 12% on taxable income between $20,551 and $83,550. Tax rate of 10% on the first $20,550 of taxable income. Tax rate of 37% on taxable income over $539,900.įor married taxpayers living and working in the United States:. Tax rate of 24% on taxable income between $89,076 and $170,050. Tax rate of 22% on taxable income between $41,776 and $89,075.  Tax rate of 12% on taxable income between $10,276 and $41,775. Tax rate of 10% on the first $10,275 of taxable income. We can also see the progressive nature of the Federal income tax ratesįrom the lowest Federal tax rate bracket of 10% to the highest Federal tax rate bracket of 37%.įor single taxpayers living and working in the United States:

Tax rate of 12% on taxable income between $10,276 and $41,775. Tax rate of 10% on the first $10,275 of taxable income. We can also see the progressive nature of the Federal income tax ratesįrom the lowest Federal tax rate bracket of 10% to the highest Federal tax rate bracket of 37%.įor single taxpayers living and working in the United States:

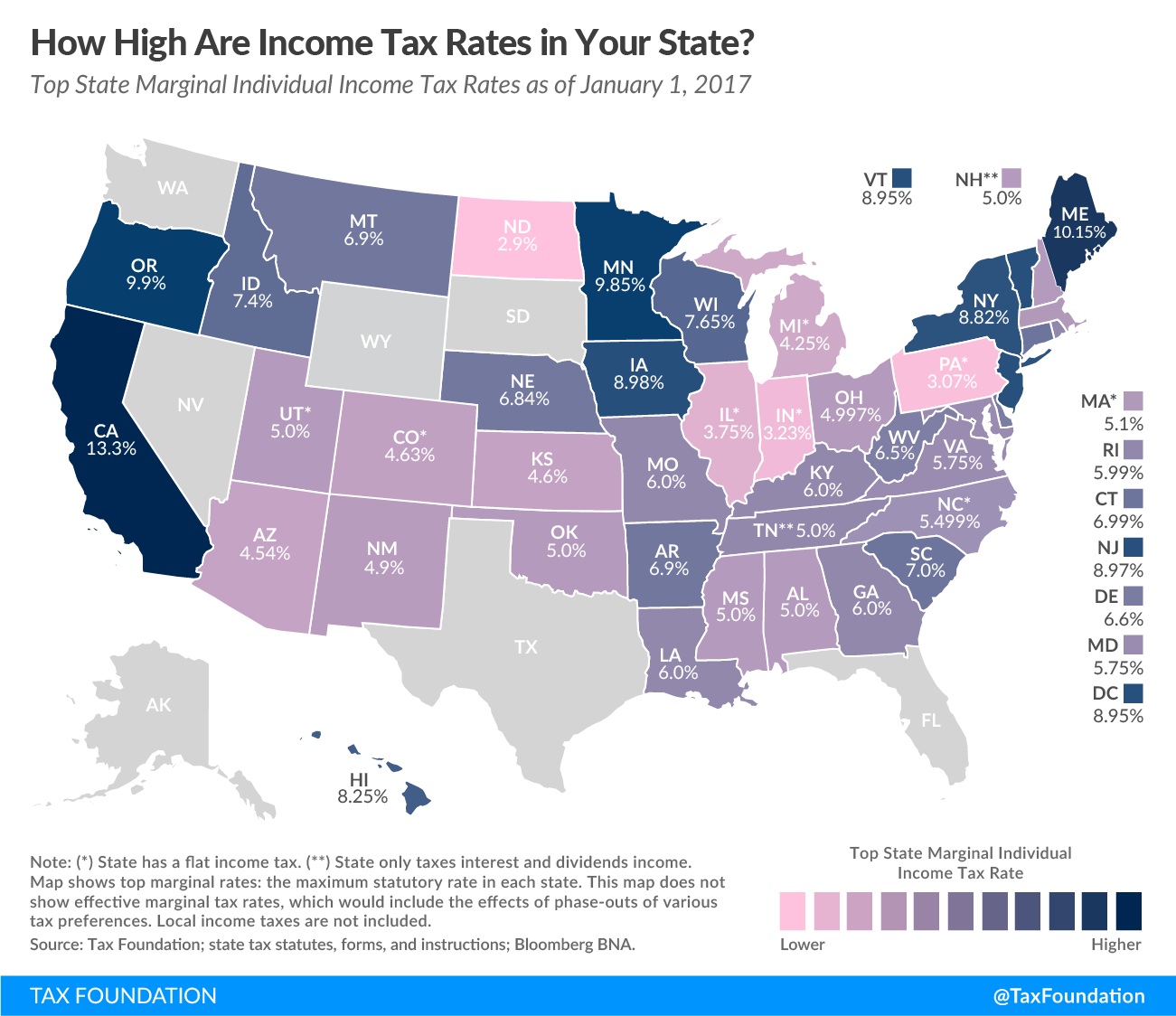

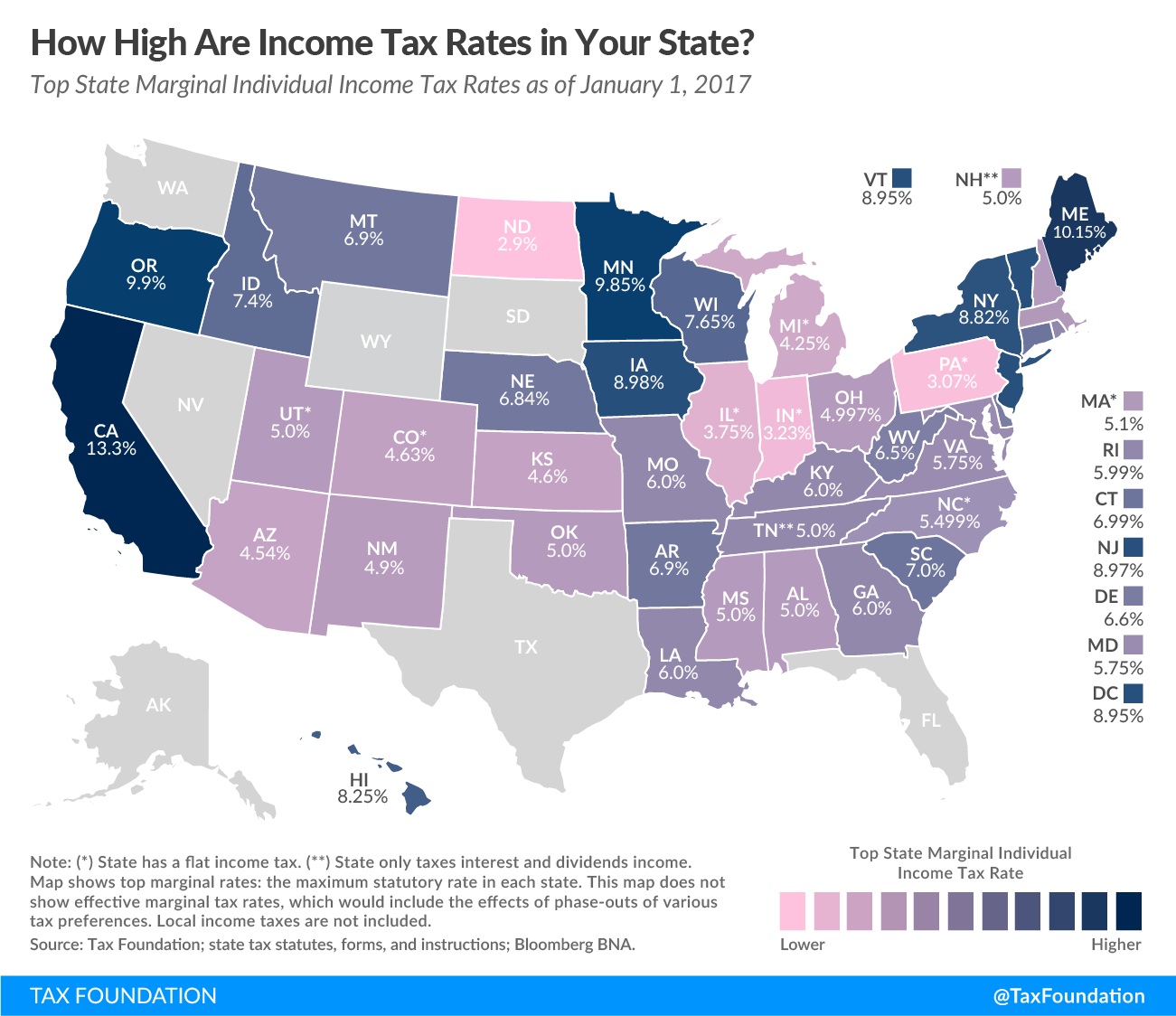

Individual income taxes differently for Single versus Married filing Looking at the tax rate and tax brackets shown in the tables aboveįor the IRS, we can see that the IRS collects Tax brackets shown on this web page are for illustration purposes only. Published at the end of each calendar year, which will include any last minute 2022 - 2023 legislative changes to the IRS tax rate or tax brackets. To determine if you owe federal income tax or are due a federal income tax refund. Published by the Internal Revenue Service Please reference the Federal tax forms and instructions booklet Source: 2022 Federal Tax Rate Schedules, published by the Internal Revenue Service (IRS).

0 kommentar(er)

0 kommentar(er)